1-to-1 money advice for financial services employees

Trusted, 1-to-1 support – for people who are expected to know it all.

Join other top Financial Services teams who already have access to Octopus Money

The pressure to know it all

Working in financial services comes with the assumption that you’ve got your own finances figured out. But behind the scenes, many professionals feel unsure, overwhelmed, or simply too busy to deal with it.

And while they may be surrounded by financial experts internally, most don’t want to talk to a colleague about their personal finances. Whether it’s the fear of judgement or just wanting to keep boundaries in place, many stay silent – even when they need support.

One workforce. Many financial realities.

From analysts to partners, from recent grads to seasoned execs – financial services firms are made up of people at every stage of life. Some are saving for a first home. Others are managing childcare, aging parents, or planning for retirement.

A one-size-fits-all approach doesn’t work – because your people don’t all start from the same place. And when support feels generic, it rarely gets used.

Trust is everything

In regulated, risk-aware industries, scepticism is natural – especially around financial help. That’s why building trust is non-negotiable. Our approach is rooted in guiding, not selling.

Octopus Group has worked in financial services for more than 25 years. As an FCA-regulated firm and a certified B Corp, we act in your employees’ best interests – always.

How Octopus Money works

It starts with a conversation – and ends with a personalised plan employees actually follow through on

Every employee:

- Is matched with the right money expert and booked into a free 1-to-1 session

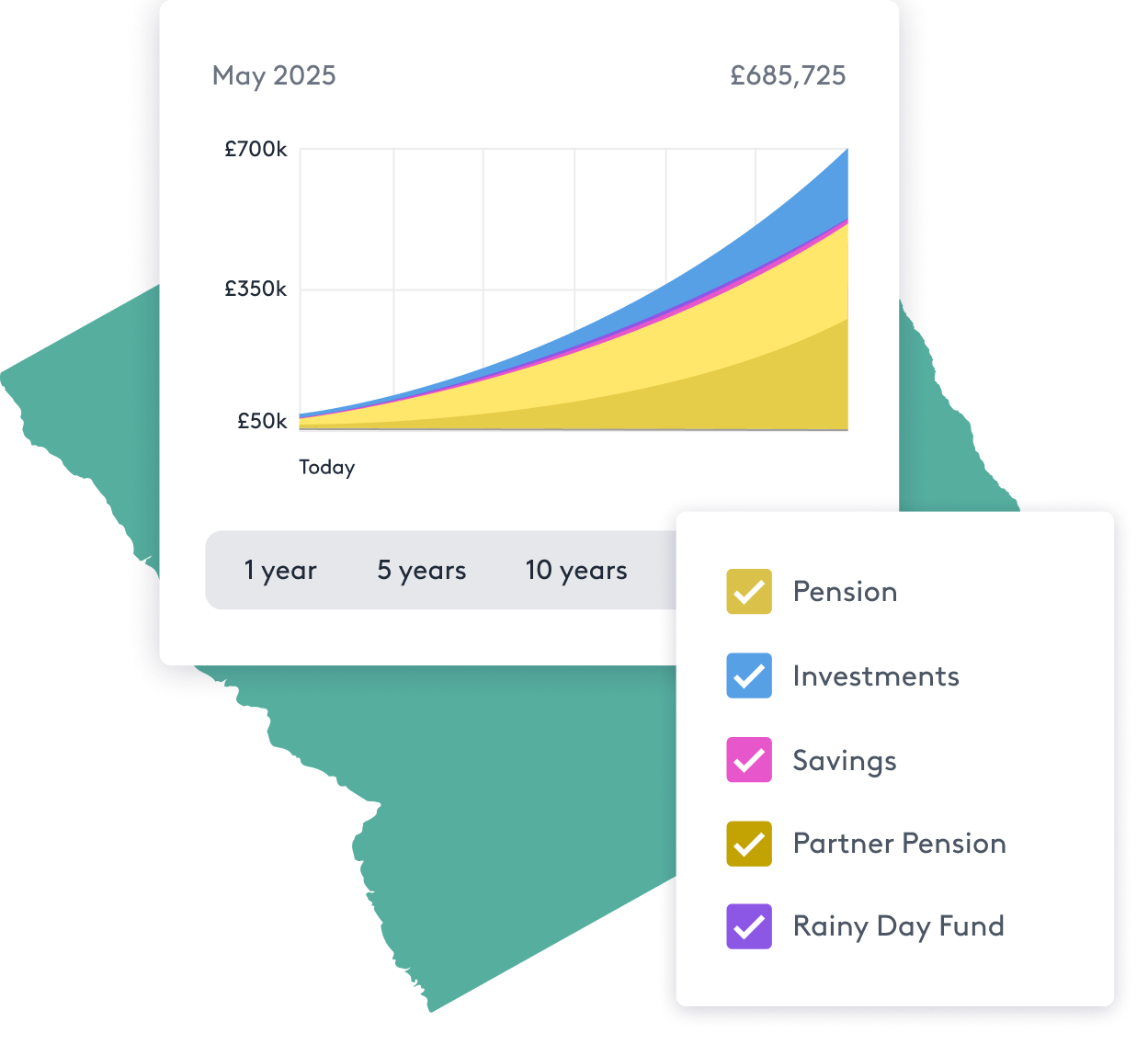

- Can go through a tailored journey to build a personalised financial plan

- Can map our their entire financial future – and explore different scenarios

- Can get clear, step-by-step recommendations to help reach their goals

How a people-first accountancy firm uses Octopus Money to break the money taboo in financial services

Nimesh Shah

CEO

Blick Rothenberg

“I’ve never received so many messages of thanks”

Blick Rothenberg, one of the UK’s leading tax and advisory firms, knew that even accountants struggle to talk about their own money. That’s why their CEO made 1-to-1 money advice a core part of their wellbeing strategy – and gave employees time during work hours to use it.

In their own words

What employees at the UK’s leading financial services companies say

“After the session I feel a lot more positive about my long term goals and look forward to taking control of my financial future.”

Employee at Aldermore

“Informative, not too formal or prescriptive and really good information which helps form my plans for my finances. looking forward to continuing my work with Samie”

Employee at BNP Paribas

“Very easy to talk to and listened to my needs – excellent service and definitely got the cogs moving for future planning in regards to money.”

Employee at Bibby

Download our financial wellbeing research

We spoke to employees from FTSE50 companies, and found out what really drives money worries, which financial benefits rank highest and three new proven solutions to employee money stress.